Read the latest news on coronavirus in Delaware. More Info

State’s dormancy laws now offer greater flexibility

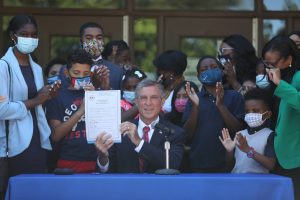

With the Governor’s recent signature, Delaware’s Captive Insurance Division is celebrating increased flexibility in its offerings to captive insurance companies. Senate Substitute 1 for Senate Bill 36 allows captives to be classified as registered series, offers clarity to provisions regarding insuring a parent company, and allows for a captive to enter dormancy after 12 consecutive months of inactivity, rather than requiring a calendar year of inactivity.

“We continue to work to streamline processes to maintain our status as one of the most attractive captive domiciles,” shared Insurance Commissioner Trinidad Navarro. “In the past, if a company stopped writing insurance business mid-year, they would need to wait 18 months to file for dormancy in order to satisfy the calendar year provision and become eligible, and requiring the captive to pay premium taxes and continue to submit statements to the department during that period. Prior to this change, it may have been easier for captives to dissolve than elect dormancy and later return to the market.”

SB 1 for SB 36, sponsored by Senator Trey Paradee and Representative Bill Bush, is the result of a multi-year effort, after legislation did not proceed during 2020’s truncated session due to COVID-19. The Department of Insurance convenes stakeholder groups to discuss legislative proposals, and had many conversations with the DCIA, Delaware’s Captive Insurance Association, about the bill.

“The DCIA thanks Governor Carney, the sponsors of the bill, and Insurance Commissioner Navarro for their support of the captive insurance industry,” Joanne Shaver, President of the DCIA, said. “The DCIA believes these changes are beneficial to captive owners, especially with respect to Delaware’s dormancy statute. The change to a continuous 12-month period allows a captive to enter dormancy status sooner than it would have been able to previously. This change will make it more favorable for captive owners to elect dormancy status over dissolution of the captive, especially when the owner isn’t 100% sure they want to dissolve their captive immediately.”

In 2020, Delaware’s robust captive insurance program contributed $2.9 million to the state’s General Fund and $1 million to the City of Wilmington. The division licensed 70 new captives last year, which may be the most reported by a U.S. domicile.

The success of the Captive division continues to earn international recognition. Delaware was recently named a finalist for Non-Asian Domicile of the Year by leading industry magazine Captive Review and was a finalist for 2020 International Insurance Domicile of the Year.

Captive insurance companies, which are owned by the entities that they insure, are usually formed by businesses that wish to better manage the cost and administration of their insurance coverage. Delaware is the world’s fifth largest and the third largest U.S. captive domicile, with 783 active captives and $5.4 billion in gross written premiums. It is one of four domiciles in the world recognized by the International Center for Captive Insurance Education as ICCIE Trained. To learn more, visit captive.delaware.gov.

Related Topics: Awards, Captive Division, captive insurance, Commissioner Navarro, Department of Insurance, Insurance Commissioner, Insurance Department, legislation, Trinidad Navarro

Keep up to date by receiving a daily digest email, around noon, of current news release posts from state agencies on news.delaware.gov.

Here you can subscribe to future news updates.

State’s dormancy laws now offer greater flexibility

With the Governor’s recent signature, Delaware’s Captive Insurance Division is celebrating increased flexibility in its offerings to captive insurance companies. Senate Substitute 1 for Senate Bill 36 allows captives to be classified as registered series, offers clarity to provisions regarding insuring a parent company, and allows for a captive to enter dormancy after 12 consecutive months of inactivity, rather than requiring a calendar year of inactivity.

“We continue to work to streamline processes to maintain our status as one of the most attractive captive domiciles,” shared Insurance Commissioner Trinidad Navarro. “In the past, if a company stopped writing insurance business mid-year, they would need to wait 18 months to file for dormancy in order to satisfy the calendar year provision and become eligible, and requiring the captive to pay premium taxes and continue to submit statements to the department during that period. Prior to this change, it may have been easier for captives to dissolve than elect dormancy and later return to the market.”

SB 1 for SB 36, sponsored by Senator Trey Paradee and Representative Bill Bush, is the result of a multi-year effort, after legislation did not proceed during 2020’s truncated session due to COVID-19. The Department of Insurance convenes stakeholder groups to discuss legislative proposals, and had many conversations with the DCIA, Delaware’s Captive Insurance Association, about the bill.

“The DCIA thanks Governor Carney, the sponsors of the bill, and Insurance Commissioner Navarro for their support of the captive insurance industry,” Joanne Shaver, President of the DCIA, said. “The DCIA believes these changes are beneficial to captive owners, especially with respect to Delaware’s dormancy statute. The change to a continuous 12-month period allows a captive to enter dormancy status sooner than it would have been able to previously. This change will make it more favorable for captive owners to elect dormancy status over dissolution of the captive, especially when the owner isn’t 100% sure they want to dissolve their captive immediately.”

In 2020, Delaware’s robust captive insurance program contributed $2.9 million to the state’s General Fund and $1 million to the City of Wilmington. The division licensed 70 new captives last year, which may be the most reported by a U.S. domicile.

The success of the Captive division continues to earn international recognition. Delaware was recently named a finalist for Non-Asian Domicile of the Year by leading industry magazine Captive Review and was a finalist for 2020 International Insurance Domicile of the Year.

Captive insurance companies, which are owned by the entities that they insure, are usually formed by businesses that wish to better manage the cost and administration of their insurance coverage. Delaware is the world’s fifth largest and the third largest U.S. captive domicile, with 783 active captives and $5.4 billion in gross written premiums. It is one of four domiciles in the world recognized by the International Center for Captive Insurance Education as ICCIE Trained. To learn more, visit captive.delaware.gov.

Related Topics: Awards, Captive Division, captive insurance, Commissioner Navarro, Department of Insurance, Insurance Commissioner, Insurance Department, legislation, Trinidad Navarro

Keep up to date by receiving a daily digest email, around noon, of current news release posts from state agencies on news.delaware.gov.

Here you can subscribe to future news updates.

"captivity" - Google News

July 15, 2021 at 07:51PM

https://ift.tt/3z1MG2X

Delaware Captive Insurance Legislation Signed by Governor - State of Delaware News - news.delaware.gov

"captivity" - Google News

https://ift.tt/3b01anN

https://ift.tt/3dbExxU

Bagikan Berita Ini

0 Response to "Delaware Captive Insurance Legislation Signed by Governor - State of Delaware News - news.delaware.gov"

Post a Comment