The Station is a weekly newsletter dedicated to all things transportation. Sign up here — just click The Station — to receive the full edition of the newsletter every weekend in your inbox. This is a shorter version of The Station newsletter that is emailed to subscribers. Want all the deals, news roundups and commentary? Subscribe for free.

Welcome back to The Station, your central hub for all past, present and future means of moving people and packages from Point A to Point B.

Wow, what a week over here at TechCrunch! Our annual tech bonanza (I can’t even call it a conference) was a flurry of activity. Our expo floor was packed, the roundtables were oversubscribed and the two stages showcased some of the most interesting people in tech.

The event culminated as it always does: naming the Startup Battlefield winner.

That process started with the Startup Battlefield 200, handpicked companies (from thousands of applications) that were vetted and chosen to exhibit on the expo floor. From here, 20 startups were selected to compete in Startup Battlefield, where founders pitched before judges for a chance to win $100,000 and the coveted Battlefield Cup. We winnowed it down to five finalists: Advanced Ionics, AppMap, Intropic Materials, Minerva Lithium and Swap Robotics. The judges who reviewed the final five were Mar Hershenson (Pear VC), Yahoo CEO Jim Lanzone, Aileen Lee (Cowboy Ventures), TechCrunch editor in chief Matthew Panzarino, David Tisch (BoxGroup) and Richard Wong (Accel).

In the end, the crown went to Minerva Lithium, a company co-founded by Sheeba Dawood and Hemali Rathnayake that wants to change the way we extract lithium.

Minerva has come up with a coordinated polymer framework that extracts critical materials from salt water in just three days and without all the harmful effects on the environment. Minerva can not only extract lithium, which it can sell at battery-grade to battery makers, it can also capture other minerals and possibly purify the leftover water for drinking purposes.

Congrats to Minerva Lithium!

Oh, before I forget: We’ve opened up pre-registration for 2-for-1 tickets to Disrupt 2023, so sign up and we’ll let you know when you can secure your seat at next year’s event.

You can always email me at kirsten.korosec@techcrunch.com to share thoughts, criticisms, opinions or tips. You also can send a direct message to @kirstenkorosec.

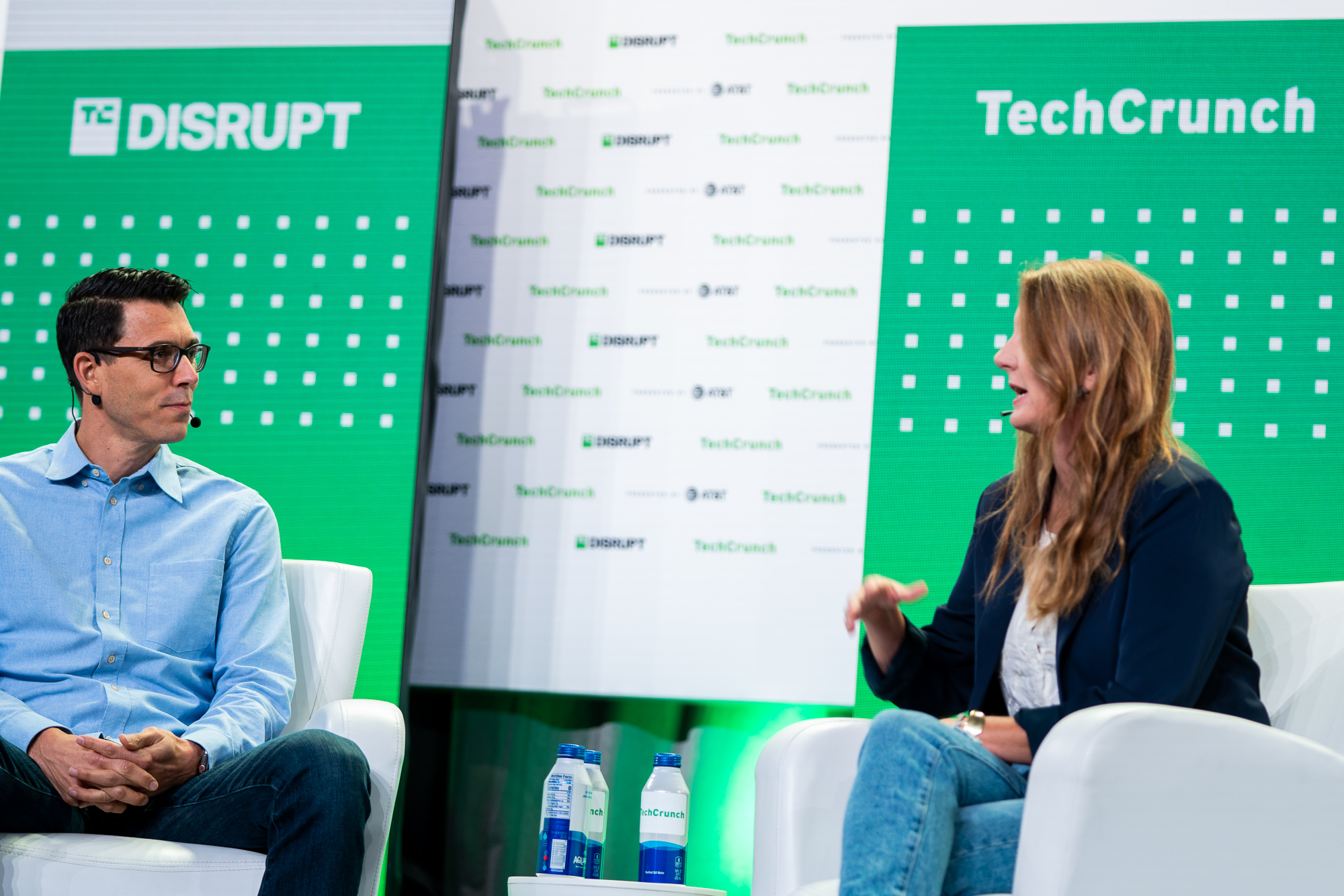

Rivian and Lyft at Disrupt

RJ Scaringe, CEO at Rivian, and Kirsten Korosec from TechCrunch at TechCrunch Disrupt in San Francisco on October 19, 2022. Image Credits: Haje Kamps / TechCrunch

During Disrupt, I interviewed Rivian founder and CEO RJ Scaringe and Lyft co-founder and president Jon Zimmer.

Both interviews provided some interesting insights on the challenges of founding and growing a company. There was even a little news in there. Here are some highlights from both.

Lyft, Jon Zimmer

On past challenges:

It wasn’t COVID, but the sustained and early fight with Uber that Zimmer believes was the hardest challenge that company has faced to date.

On autonomous vehicles:

“I think it’s too early to pick, you know, one winner and so today, it’s about having multiple partners. Ten years from now? It’s too hard to predict.”

On Tesla FSD and whether Lyft should tell drivers not to use while shuttling riders:

“We do not have have a policy currently. You know, we think that the regulatory bodies are best, you know, when it comes to that level of safety.”

On the Biden administration proposal:

“The recent Biden administration proposal that you’re talking about basically just returns things to the way they were in the Obama administration where all our drivers were independent contractors. Typically, we are governed at a state level. Federal government is important and matters for all industries, but it’s really interpreted at the state level, of which I would argue we’ve made significant progress over the last few years, California being one example.”

Rivian, RJ Scaringe

On the future product front:

- More than half of Rivian’s 15,000 employees are working on future product pipeline, including the R2 platform, which will focus on smaller and cheaper vehicles.

- Yes, there will be 400-mile “Max Pack.” Scaringe didn’t provide a timeline.

- Micromobility, specifically an e-bike will be part of the lineup.

On the recall:

- A “significant majority” of the more than 12,000 vehicles that were recalled earlier this month have been fixed.

- “It was really powerful for us to respond so quickly, and I think what we saw from customers — of course, there’s frustration on anything like this — but that we were trying to do the best possible job we could. We were authentic about it. We didn’t we didn’t sugarcoat it. We said we’re gonna go fix this. And so it actually has been really quite positive.”

On the supply chain:

- Think the semiconductor chip shortage was bad? Scaringe said that shortage is “an appetizer to the degree of the sort of supply chain constraint we’re likely to see across the battery supply chain over the next 15 years.” Woof (that’s my reaction).

- “The battery supply chain as we know it for lithium-ion batteries, whether you’re looking at lithium hydroxide or lithium carbonate, was built largely around consumer electronics and so it’s very small. It’s not a huge supply chain. And so it has to grow by 20x or on the order of 20x over the next 10 to 15 years. And so the level of investment needed to go build that is is staggering. And moreover, I think the level of risk concentration given that it hasn’t been built in the United States is a real thing.”

Micromobbin’

The big micromobbin’ news this week fell squarely into the gloomy category. I’m talking about Bird and its plans to exit several markets across the world, including Germany, Sweden, Norway and “several dozen additional, primarily small to mid-sized markets” across the U.S., Europe and the Middle East.

Deliveroo is partnering with Volt to trial the use of e-bikes for food delivery in the U.K.

You’re reading an abbreviated version of micromobbin’. Subscribe for free to the newsletter and you’ll get a lot more.

Deal of the week

TechCrunch Disrupt kept me pretty busy, but a few deals got my attention. One news item that rose to the top of the heap was Mobileye setting terms of its IPO. The company, which plans to trade on the Nasdaq under the ticker symbol MBLY, plans to offer 41 million shares at $19 a share, the assumed midpoint.

Bain Capital and Abu Dhabi Investment Authority completed their acquisition of MerchantsFleet, a fleet management company based in New Hampshire.

Want more deals? A whole list of them were in the subscription version this week. Subscribe for free here.

Notable news and other tidbits

Autonomous vehicles

During Disrupt, I squeezed in a short and memorable ride in one of Cruise’s driverless vehicles. The ride itself was fairly uneventful. I was given access to the app by Cruise and was able to hail the vehicle about 30 minutes before the normal operating hours began. It’s possible that my ride won’t mirror what current customers experience because I was in a vehicle used by employees.

My ride was uneventful (hooray, no phantom braking or sudden, unexplained actions). However, the Cruise vehicle would not turn right on red, which clearly annoyed the human drivers behind it. On one occasion, a vehicle ripped by the Cruise vehicle in an effort to pass before the next light; that’s not exactly ideal.

The user interface inside the vehicle (so the displays) allows customers to view a map or play various music mixes. As far as I could tell there wasn’t a way to actually skip through songs. There was also a big giant “End Ride” button, which again seems like a good feature to have.

My takeaway from this admittedly brief ride is that Cruise has made considerable progress on the commercial front; I’d feel comfortable using the service. However, I’d like to see refinements on the UI and UX side of things and hope that vehicles adopt a more confident driving style and start taking those right turns.

Meanwhile, Waymo said it plans to launch a robotaxi service in Los Angeles.

Electric vehicles, charging & batteries

Arrival is restructuring again and turning its attention away from the U.K. and toward the U.S. market.

Gene Berdichevsky of battery chemistry company Sila talked to TechCrunch one year after our original interview to provide his take on the super-hot battery industry. A few of his insights:

- The Inflation Reduction Act is a very American piece of legislation — meaning the U.S. took its time getting to it, but when it finally enacted this piece of climate legislation, it was a “Go big or go home” situation.

- There’s no way U.S. battery companies today can scale to meet immediate EV demand. By 2030, it should start to level out.

- New lines are being drawn for investments into battery materials companies.

- As a battery maker, having an OEM in your corner will help you avoid a lot of the pitfalls of supply constraints.

Foxconn unveiled two EV concepts at its third annual Hon Hai Tech Day — a Model V electric pickup truck and Model B electric crossover hatchback.

General Motors revealed the production Cadillac Celestiq. It is big in every way and has some interesting features. But will consumers plunk down the $300,000 (or more) to buy it?

The automaker also unveiled the GMC Sierra EV — its third vehicle under the GMC brand.

Tesla Q3 earnings were released. Tl;dr: revenue of $21.45 billion, which was just short of expectations; net income of $3.3 billion (nearly double from the same year-ago period); reiterated guidance on Semi and 50% annual growth on vehicle sales. The energy unit was a bright spot.

Want to read more of the notable reads plus other bits of news from the week? The Station’s weekly emailed newsletter has a lot more on EVs and AVs, future of flight, insider info and more. Click here and then check “The Station” to receive the full edition of the newsletter every weekend in your inbox.

"bird" - Google News

October 25, 2022 at 12:30AM

https://ift.tt/lovu8BY

Arrival restructures (again), Bird shrinks and highlights from Disrupt - TechCrunch

"bird" - Google News

https://ift.tt/D52kmU6

https://ift.tt/P37ghCt

Bagikan Berita Ini

0 Response to "Arrival restructures (again), Bird shrinks and highlights from Disrupt - TechCrunch"

Post a Comment